How could we benefit from blockchains to develop collaborative tools to monitor the economic consequences of climate change?

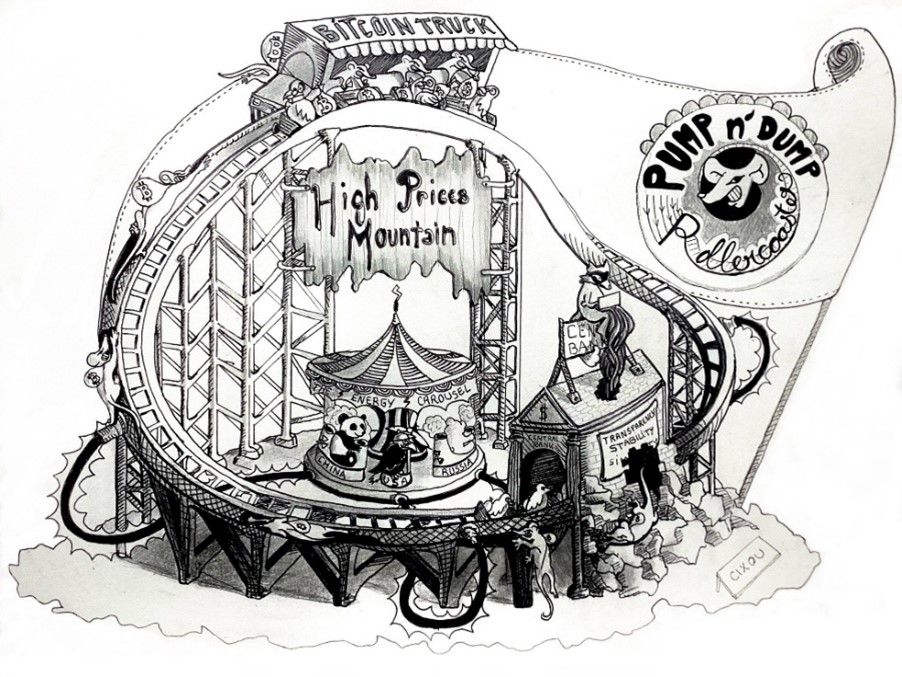

Climate change is already impacting our economy worldwide, not for the best in most cases, and this phenomenon is expected to grow in importance in the coming decades. There is a need to predict not only future climate parameters but also the resulting economic behaviors of our countries on a macro level.

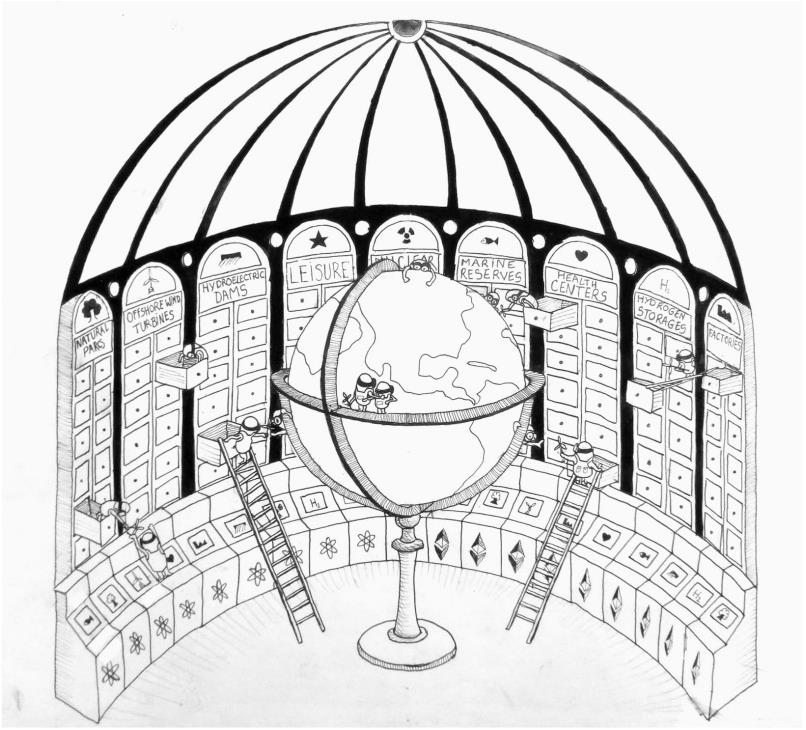

Decision makers will require more accurate cost-benefit analysis taking climate change into account, moreover in a context of an increase of raw materials and energy scarcity, limiting even more their leeway in their action plans. Major economic issues are at stake, putting pressure on future global welfare.

As a basic example, if in some regions hydroelectric dams are expected to produce less energy, because of higher future evaporation rates or smaller rainfall amounts, decisions must be taken now concerning the architecture of the electric grids, to maintain reasonable prices of the electricity.

In the same way, what would be the point of subsidizing a food processing plant if its inputs are not expected to grow anymore in the surrounding area? This area would benefit more from accurate economic predictions to prepare its adaptation strategy than from blind subsidies.

The cooperative nature of the blockchain technology could help us in modelling future economic behaviors using a bottom-up approach, turning future financial consequences on the economic players resulting from the climate change into macroeconomic predictions. We would obtain greater economic resilience for our society.

So, concretely, how could we proceed?

-Bottom level- Impacts on assets

First let’s translate climate risks into financial values. Indeed, considering an economic player, whether from the public or the private sector, relies on its fiscal viability, it makes sense to evaluate impacts from climate risks by measuring the resulting financial gains or losses on its assets. Any type of asset and any climate risk could be considered, such as the physical ones (e.g., changes in the heat waves frequency or the sea level rise), or the transition risks like the regulatory ones (e.g., a technological ban).

I recently designed such a methodology, capable of measuring the financial impacts resulting from climate change on any type of asset, such as industrial plants or companies in the tertiary sector.

-Upper level- Macroeconomic impacts

After having analyzed financial impacts for a first set of assets, macroeconomic patterns of the consequences of the climate change on each economic sector will already emerge. Indeed, extrapolation on the financial impacts will be feasible for other assets having similarities with those previously studied. Then, existing economic tools will help us determine the knock-on effects each economic sector will have on the other sectors. An iterative model could be built to produce a final picture of the future state of the economy for every climate scenario and for every area selected. I have also already designed this methodology.

Blockchains could help us in designing such a model. This technology is above all a decentralized design for web-based networks. With a native token anyone using an application on a blockchain can finance any additional service providers interested in managing the hardware of the network. The model could be built on a blockchain as an open-source and collaborative application, to get rid of any lack of transparency of the calculations. Moreover, frequent required updates of the input data of such an economic model could be transferred automatically to the application using blockchain oracles such as Chainlink or Band.

It is also good to know that in function of the validation process of a calculation, the energy consumption of a blockchain can be sharply reduced. Proof of stake blockchains, such as those built on the Layer 0 Cosmos, have a very limited environmental impact compared to proof of work ones like Bitcoin.

Economic modelling is an adequate answer to the rising complexity of the issues we must face. We surely shouldn’t avoid this option.

Don’t hesitate to contact me if you require economic modelling skills for your strategic decisions, I will be glad to furnish tailor-made models.