The decrease of the dominance of the US dollar, and to a lesser extent of the Euro, is at stake at the moment. But what does that mean in practice?

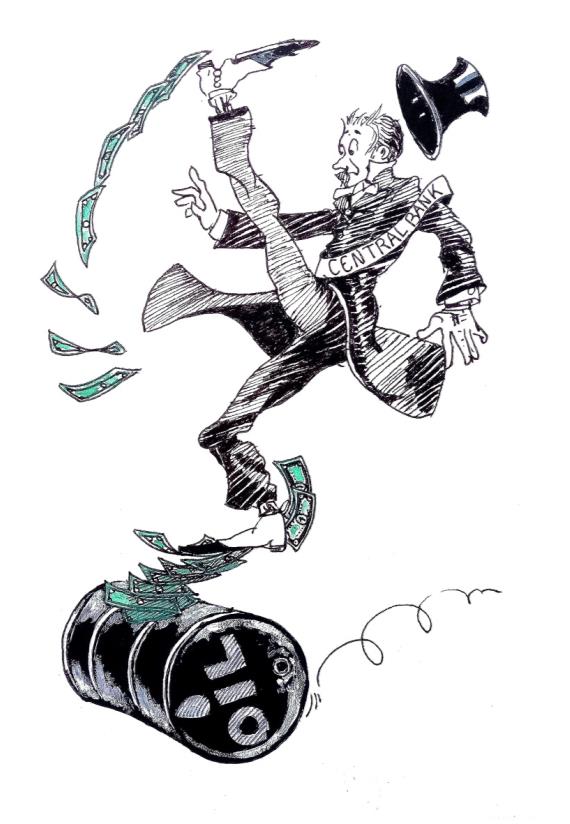

It has a lot to do with the “Cantillon effect”: the money supply produced by a central bank regulates the inflation, but if you have a competitive advantage by having a priority access to the printing press of such a bank, your funds increase in a higher proportion than their value is diluted by the inflation. In other words, you become wealthier without making many efforts. Fair or not, it’s a fact.

As a country, if your currency is frequently used abroad, since you control the central bank, you benefit from this Cantillon effect. To some extent, this is how western countries have managed their debts and their economies until now, by exporting their inflation abroad.

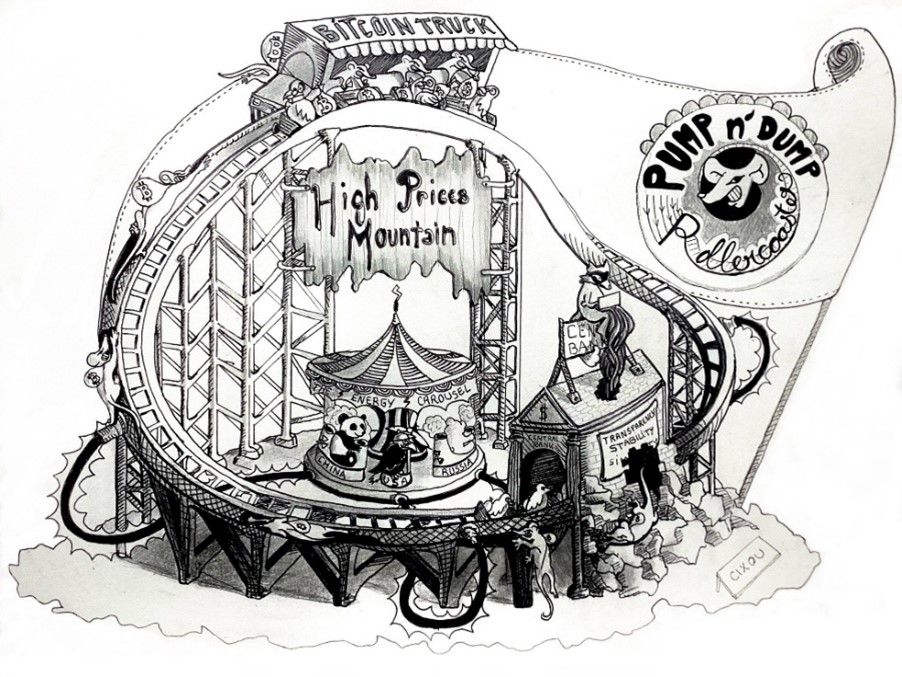

But now, due to geopolitics, things are changing, and there is a greater diversification than before in the currencies used for the trade of energy, like the oil, reducing western countries capacity to benefit from the Cantillon effect. There are few times in the History that such economic disruptions happen. As a consequence, their economic structure might risk suffering from shortages of public funds, or by facing higher inflation if they keep printing money.

For any purpose you are involved in, whether it’s about climate change, the overall welfare or the profitability of your business, you can’t avoid taking into account the economic environment to achieve your goals.

The future can’t be predicted, especially if you have not studied at Hogwarts (I wish I had received a letter), and maybe this scenario won’t materialise in practice. Nevertheless, economic modelling and economic analysis can help you with mitigating your risks.

Please get in touch with me if you require economic modelling skills for your strategic decisions, I will be glad to furnish tailor-made models.